Sudir

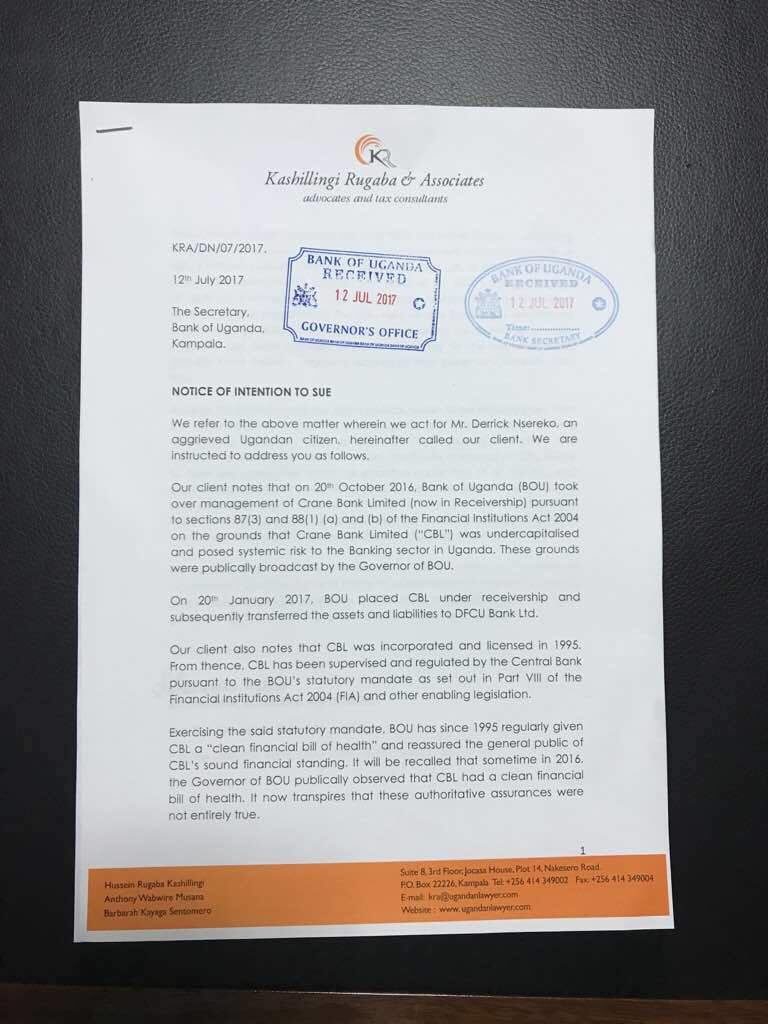

A concerned Ugandan citizen identified as Derick Nsereko has threatened to sue Bank of Uganda (the Central Bank of Uganda) for what he describes as failure to supervise Crane Bank (CBL) before it was put under receivership.

According to the notice delivered to B.O.U’s Secretary on 12th/ July/ 2017, it details that the central bank has since Crane Bank’s incorporation in 1995 supervised and regulated the financial institution pursuant to the Central Bank’s statutory mandate as set out in Sections of the Financial Institutions Act 2004 and other enabling legislation.

Through his lawyers Kashillingi, Rugaba & Co. Advocates, Nsereko argues the Central Bank has since 1995 regularly given Crane Bank a “clean financial bill of health” and reassured the general public of CBL’s sound financial standing.

Crane bank was owned by wealthy property mogul Sudhir Ruparelia and was taken over by the Central Bank in January 2017 on grounds that it was “undercapitalized” and “posed a systemic risk to the banking sector in Uganda.”

The bank was later sold to Dfcu bank following a forensic investigation into its operations.

“It will be recalled that sometime in 2016, the Governor of the Central Bank stated that Crane Bank had a clean financial bill of health. It now transpires that this was not entirely true,” the letter adds.

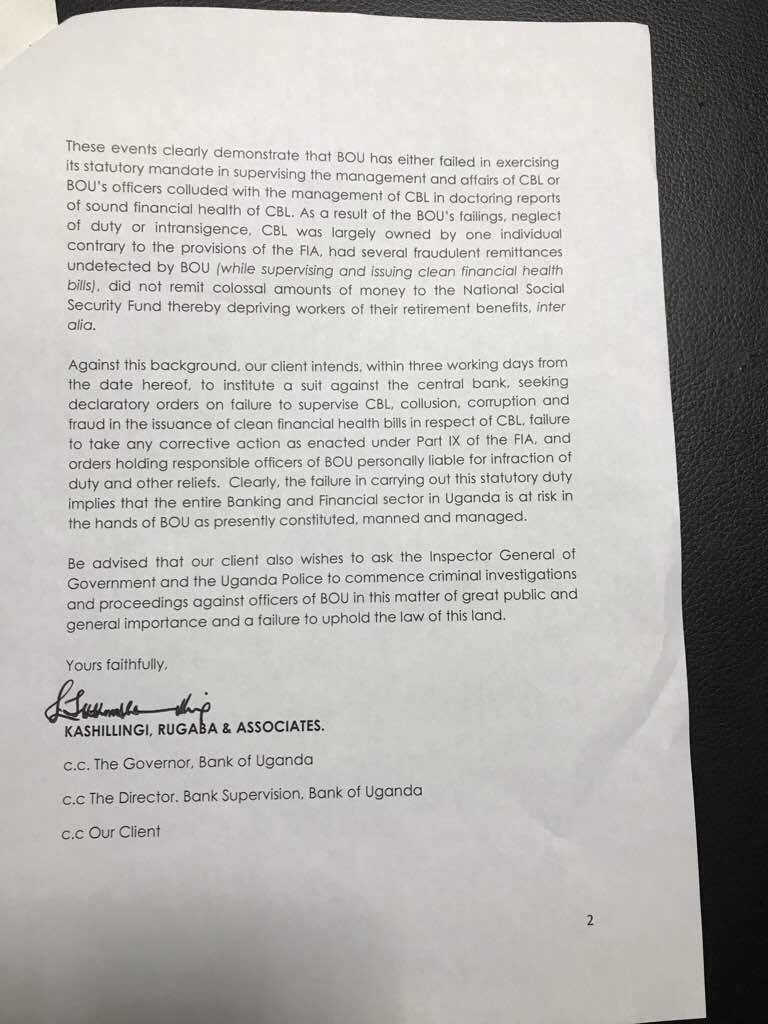

In in the same petition sent to BOU, Nsereko said he “intends, within three working days from the date hereof, to institute a suit against the central bank, seeking declaratory orders on failure to supervise CBL, collusion, corruption and fraud in the issuance of clean financial health bills in respect of CBL and other relief as detailed below in the letter.