Legislators have rejected a proposal giving the Minister of Finance powers to pay taxes on behalf of an individual or organisation.

This followed presentation of a report by the Committee of Finance on the Tax Procedures Code (Amendment) Bill, 2018 on Tuesday 23 May 2018.

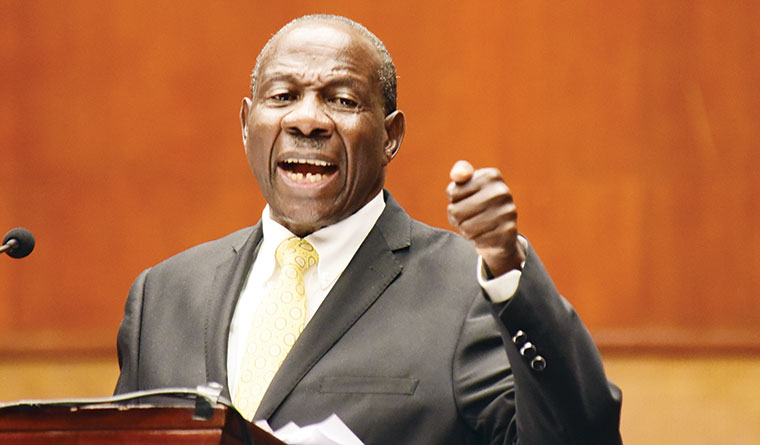

The report was presented by the Chairperson of the Committee Hon Henry Musasizi during the plenary chaired by the Speaker, Rebecca Kadaga.

The Bill seeks to amend the Tax Procedures Code Act, 2014, Act No. 14 of 2014 to provide for due dates for filing returns under the Lotteries and Gaming Act, 2016; to provide for the Minister to pay taxes on behalf of a person and to waive all unpaid taxes due and unpaid by government as at 30th June 2Ol8. The Bill also seeks to provide for electronic receipting and invoicing and to provide for penal tax relating to electronic receipting and invoicing.

Musasizi said that the Committee found it unacceptable for the Minister to pay taxes for any person for the acquisition of goods and services.

“The Minister of Government for that matter should not be pay for anyone especially those who are earning an income and profits,” he said.

Musasizi said that the Minister is asking for the ability “to pay taxes for whomever they wish”.

The Minister of State for Finance, Hon. David Bahati argued that the government entered into Memoranda of Understanding with some companies like Nytil and Palm Oil Company in Kalangala on incentives and they need to continue supporting them.

“We had promised to continue supporting these companies. However, Parliament stopped it yet these companies have been able to support the population in the areas they operate,” he said adding, “since a Minister has no power to waive taxes, we suggest that the law is amended so that money is provided through a budget to the Minister to pay the taxes”.

Hon. Patrick Nsamba (NRM, Kassanda North) supported the position of the Committee adding that it did not make any financial sense for the country to allow such actions.

“It is not acceptable for a company to get away with that; we need to know the nature of such agreements that facilitate paying taxes for individuals. Therefore, these decisions need to go through Parliament,” he said.

Hon. Paul Mwiru (FDC, Jinja Municipality East) said that there would be many irrational decisions taken by the Minister to pay taxes for whoever they want if power is left to them.

“There are companies that we know have been exempted without the Ministers coming to Parliament which is something we want to prevent,” he added.

Hon. Medard Lubega Sseggona (DP, Busiro East) said that government gives incentives to attract investors to come and pay taxes for the nation to benefit but not to exempt them from tax.

“We legislate to prevent mischief; I smell mischief like companies being exempted from paying tax. The Minister is going to use their blanket power to hawk investors and people will get away without paying taxes,” he noted.

Sseggona said that Parliament had power to “dictate tax and we have a power to waive it. To give the work to the Minister is to commit a mistake”.

Col. Fred Mwesigye (NRM, Nyabushozi County) added that investors are supposed to be rich when they come to invest in Uganda.

“They get loans cheaply from their local banks to invest here; it would be an injustice to a developing country for these big profitable companies to operate without paying tax because they benefit from the tax waivers,” he noted.

Kadaga said that there are many companies which have shares with the government but have never declared dividends.

“I hear the Minister giving an excuse of jobs created but we want that accountability; we cannot allow digression,” she added.

Parliament unanimously deleted the clause before passing the Bill.