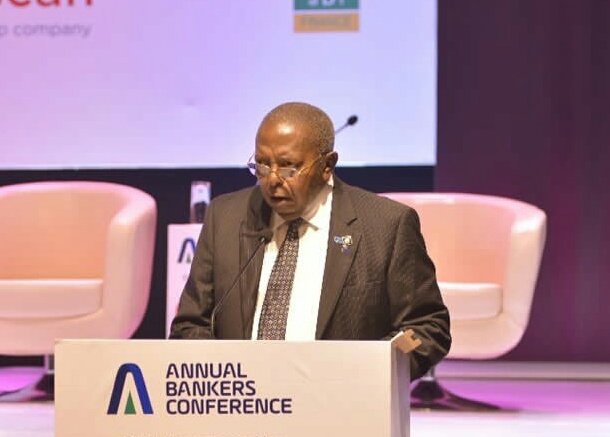

Central Bank Governor, Emmanuel Tumusiime Mutebile today added the Uganda Bankers’ Association Annual Bankers’ Conference at the Kampala Serena running under the Theme “Financial Sector Stability: Managing Risk in a Fast Growing and Fast Changing Environment”.

Speaking during the conference, Mutebile revealed why the central bank took over Crane Bank.

Mutebile said that Crane Bank was taken over in order to minimize the losses incurred and protect the interests of its depositors since it had been declared massively insolvent as a result of mismanagement and fraud.

Mutebile He said that in order to protect the interests of a distressed bank’s depositors, the regulator has a responsibility to intervene promptly in a bank that is severely undercapitalised or insolvent, and, if necessary, to take over the bank and resolve it.

Mutebile added that after the BoU had intervened in Crane Bank and taken it over in October 2016, an inventory of its assets and liabilities was commissioned and carried out by a reputable accounting firm.

“After the BoU had intervened in Crane Bank and taken it over in October 2016, an inventory of its assets and liabilities was commissioned and carried out by a reputable accounting firm. This inventory found that Crane Bank was massively insolvent, with core capital of negative Shs. 240 billion, as a result of mismanagement and fraud. The notion that this bank could have been rehabilitated by its owners – the same people who were responsible for its failure – if only the BoU had provided more liquidity support and allowed the owners to remain in control, is not tenable.” Mutebile said.

He added that in resolving a failed bank, the Financial Institutions Act provides for several resolution modalities, these include; the failed bank can be sold as a going concern, it can be merged with another financial institution, it can be subject to a purchase of assets and assumption of liabilities transaction (P&A) or put into liquidation.

Most of the banks, which have failed in Uganda during the last 20 years, either had very little franchise value or were too heavily insolvent to be sold on a going concern basis or merged with another bank. Mutebile said that in this case, the feasible options were a P&A or a simple liquidation.

“Since 2010, the BoU has intervened in five banks; closing three of them, and taking two others into temporary statutory management. In none of these banks did depositors lose their money, nor was there any danger caused to the stability of the financial system,” he said.

Mutebile revealed that the intervention in Crane Bank was the most difficult of these interventions and the one which was potentially the most problematic, because it was a large bank of systemic importance and because of the huge magnitude of the losses it had incurred.

“Nevertheless, the BoU was able to resolve Crane Bank smoothly. It remained open under statutory management until most of its assets and liabilities could be transferred through a P&A to a suitable acquiring bank, DFCU Bank, thereby avoiding disruption to its customers. None of its depositors lost the money,” he said.