The ministry of finance has called upon Ugandans to focus on other issues than demanding for the refund of the collected Mobile 1% Mobile money tax.

Speaking to the media, the permanent secretary Keith Muhakanizi said that this tax was collected legally and spent legally and thus repaying cannot easily be done.

This comes at the time when legislators are calling for reversal of taxes that were collected under 1% since it was illegally collected.

He said that all said illegal tax was collected and has been spend under the ongoing second quarter thus government has no money to repay back to customers.

This week, Parliament voted to reduce the 1 per cent tax originally imposed on all mobile money transactions. With the amendment contained in the Excise Duty (Amendment), (No. 2) Bill, 2018, the 0.5 percent tax will be charged on mobile money withdrawals only.

In May this year, government imposed a 1 per cent tax on all mobile money transactions including deposits, transfers and withdrawals. With the implementation of the tax taking effect at the start of the 2018/2019 financial year on 1 July 2018, protests from MPs and the public forced government to present a new Bill, the Excise Duty (Amendment)(No.2) Bill, 2018 “to limit the taxable mobile money transactions to withdrawal and reduce the duty payable.”

The Committee on Finance, which considered the Bill, backed the government proposals to reduce the tax and to apply to withdrawals, but in a Minority Report, MPs led by Hon. Ssemakula Luttamaguzi (DP, Nakaseke South), recommended that the tax be dropped altogether.

He highlighted proposals by various stakeholders including from the Finance Ministry, the banking sector, civil society organizations and mobile money firms who argued that the proposed tax was double taxation given that Government was already charging excise duty of 15 per cent on transaction fees and 10 per cent withholding tax on agent commissions.

Last week, Parliament failed to take a vote on the Bill due to lack of the required quorum in the House.

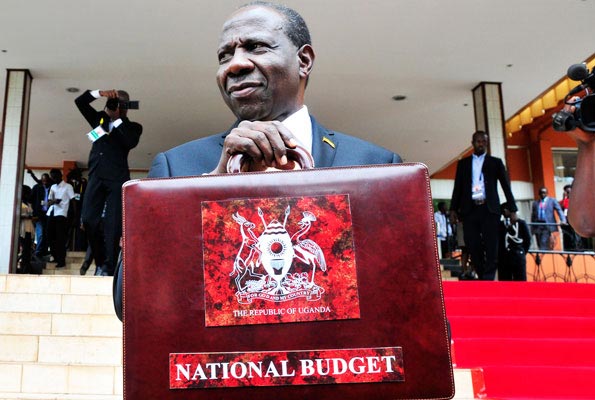

State Minster for Finance, Hon. David Bahati, said the tax collection was intended to raise Shs 115 billion and would help check on the country’s debt burden and finance the expenditure priorities already appropriated by Parliament during the budgeting process.

“Increased borrowing means an increased debt burden, so we need to increase our tax revenue mobilization to promote self-reliance in financing our programmes at a reduced cost of borrowing,” Bahati said.

In Tuesday’s sitting, where members voted on particular clauses of the Bill, 164 members voted to maintain the provision provided in the Bill, while 124 wanted the provision dropped.

The amendment means that a tax of 0.5 per cent of the value of a transaction will be charged on withdrawal of mobile money.

The Excise Duty (Amendment) (No.2) Bill, 2018 will now await assent by the President.