While some Financial Technology Companies (FinTechs) are still struggling with the LevelOneProject principle of Same Day Settlement, Beyonic/MFS Africa has redefined this standard by moving a step further to effect all its outstanding payments within minutes.

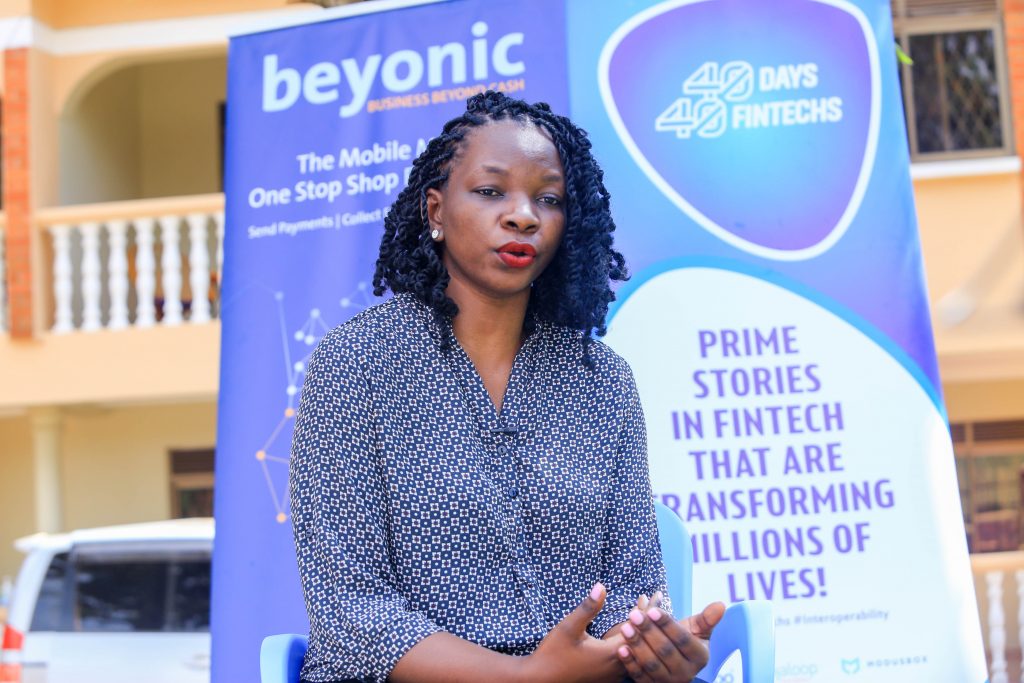

This, according to Doreen Lukandwa, the Beyonic/MFS Africa Vice President, Global Enterprises, seeks to ensure that they use their digital platforms and available infrastructure to make market challenges obsolete.

“We are a solution provider to the challenges our partners face; it doesn’t matter how small or big your business is, we have a solution for you and we ensure real time settlements to facilitate your business growth,” Doreen Lukandwa notes.

“In the current lockdown, a lot of businesses are asking themselves how they can continue to make money, reach their customer in the safest and most affordable way possible or how to scale their businesses beyond the confines of one district or country. We enable them do exactly that. Also given the current situations where people have to work remotely and are disconnected from their customers, FinTechs like Beyonic have to be very innovative around how they enable businesses to continue to thrive.

“This explains why during theses COVID-19 times, we have focused on refining the answer to the question for you. When you get a Beyonic account, all you have to do is provide basic Know-Your Customer (KYC) to open an account and you will be able to continue operating your business without having to deal with physical cash. You only need to have the mobile money numbers of the people you would want to send money to or those you want to collect money from and communicate widely that you can accept payments through your platform,” she explains.

About Beyonic

Beyonic is a digital payments platform that facilitates payments integration across the African continent by integrating all telecoms in Uganda and in other African countries where it operates.

Thus, once one connects to the Beyonic platform, they will have access to all the networks across all countries where it operates, enabling access through a single log-in. The countries include Uganda, Ghana, Rwanda, Tanzania and Kenya, among others.

“When you log-in into that account as a business, you can effect payment to as many people as you would like to or receive payments from as many people as you would like to,” Lukandwa says.

A few months ago, Beyonic merged with MFS Africa, enabling it to increase the number of markets available for businesses to operate across the continent.

According to Lukandwa, MFS Africa’s primary vision is to make cross-border transactions easy by easing payment methods.

“To us making borders matters less doesn’t just mean allowing your business go to many other markets but also things like equality, with gender being one of them,” she notes, adding that Beyonic/MFS Africa is women centric, with over 53% of its employees being women.

The FinTech is also deliberate at making more women-owned and led businesses access their platform to enable their businesses to thrive.

40 Days 40 FinTechs

Beyonic is one of the firms participating in the second edition of the 40-Days 40 FinTechs , organised by HiPipo in partnership with Crosslake Technologies, ModusBox and Mojaloop Foundation, and sponsored by the Gates Foundation.

Lukandwa applauded HiPipo for the initiative, saying that it has provided a platform to aggregate information and players in the ecosystem to create awareness about available solutions to address market challenges.

She, however, notes that while Uganda is extremely entrepreneurial, this needs to be matched with the opportunity to scale and advance these enterprises.

“One of the areas in which we are lacking is reducing the cost of operations and scale; for a lot of these businesses, it is very expensive for them to have startup capital, employ staff, maintain these businesses and building capacity on best business practices. These are some of the primary loopholes where I think we need to get together as stakeholders to agree on what we want to achieve and how to achieve it and I think consolidating efforts around KYC would be key.”

The HiPipo Chief Executive Officer Innocent Kawooya applauds Beyonic, saying it has played a great financial inclusion across Africa, as its products and services are impacting thousands of people at the last mile.

He adds that FinTech in Africa offers attractive opportunities and that investors are rightfully picking interest in the various startups offering a plethora of services, ranging from payments and lending, remittances and cross-border transfers, among others. Currently, Beyonic can be accessed through its website – www.beyonic.com or through social media, Facebook, WhatsApp, Twitter, and Instagram as its offices are currently closed due to the lockdown but will be reopened once it is lifted.