Many businesses always find themselves entangled in non-core business functions and end up giving little time to core operations, which affects their operations.

Payments are one of those non-core operations that businesses, especially the Micro, Small and Medium Enterprises (MSMEs) tend to spend a lot of time on.

To help them manage their daily payments needs without interrupting their core business operations, however, Kanzu Code, a software development company, came up with an aggregation solution dubbed Kanzu Money to enable MSMEs conveniently, effectively and securely make bulk payments.

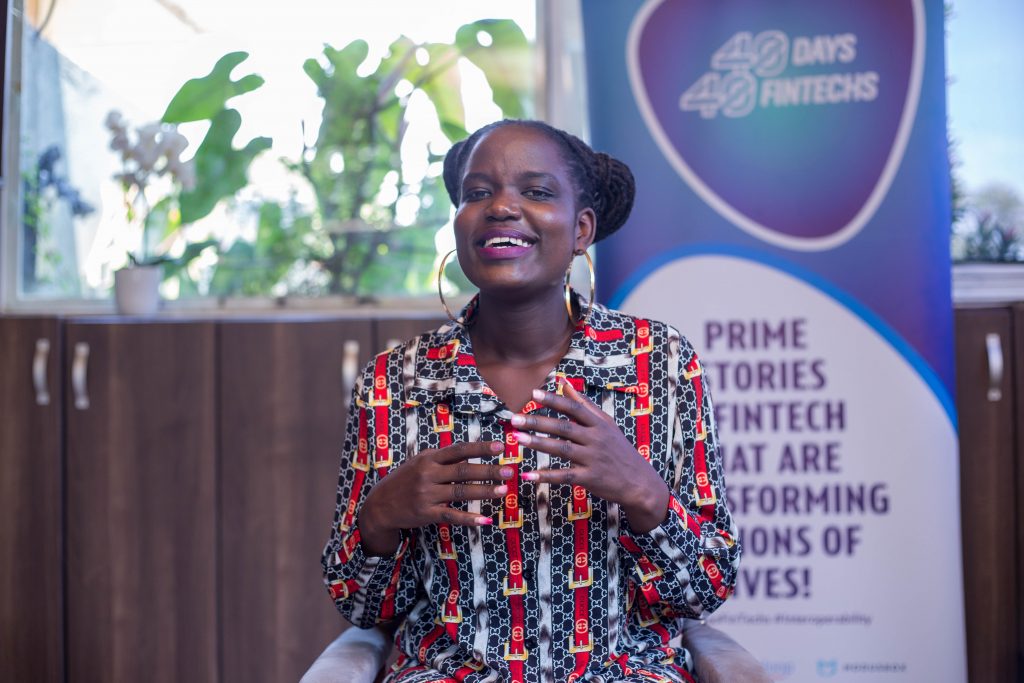

According to the Kanzu Code Software Engineer Patricia Atim, the solution allows businesses make bulk payments to their employees, suppliers and vendors, among others, in a single click.

The system uses a Comma Separated Values (CSV) file where all the details including particulars to the people to be paid and the respective amounts, are input and then uploaded onto the web-based Application (App) system to effect the payments, accordingly.

The solution is an interoperable as it uses the Mojaloop software. This means that payments can be effected from the system to any mobile money service provider or bank, effectively and at the same cost.

“This solution helps a small business owner that needs to make several payments yet the recipients are on different networks yet they have to pay via mobile money,” she explains.

She adds: “Imagine if you have 50 people to pay daily; making a single payment at a go to all those people is a lot of work. This means that you either have to carry the money with you to pay them or look for a money agent and ask them to pay one by one. The whole process is tiring and cumbersome.”

The solution not only eliminates the risk of carrying cash but also enables a business to make payments at once to all the people instead of having to pay each, one by one.

Kanzu Code also offers other solutions including custom digital solutions, online stores and Kanzu jobs, among others.

Having a bias towards women’s financial inclusion, Atim says that Kanzu Code plans to roll out a strategy to create initiatives that will be tailored specifically to encourage women to sign up.

She notes that four in 10 MSMEs are owned by women, yet most women are unhappy with the current FinTech solutions on market as they were not responsive to their needs.

Kanzu Code, which participated in the first ever Women in FinTech Hackathon last year, implements Real-Time payments and Same-Day settlements, which are among the financial inclusion principles.

They are among the firms participating in ongoing second edition of the 40-Days 40-FinTechs programme, organized by HiPipo in partnership with Crosslake Technologies, ModusBox and Mojaloop Foundation, and sponsored by the Gates Foundation.

Atim commends HiPipo for the programme, saying it has played a major role in publicity and raising awareness about the crucial role FinTechs play in the country.

While Uganda’s FinTech industry is steadily growing, Atim notes that there are a number of challenges including the prohibitive regulations and policies, high cost of lending and difficulty of attracting funding from investors.

The HiPipo Chief Executive Officer Innocent Kawooya, however, says that FinTech in Africa offers attractive opportunities and that investors are rightfully picking interest in the various startups offering a plethora of services, ranging from payments and lending, remittances and cross-border transfers, among others.

He explains that the 40-Days 40-FinTechs initiative seeks to boost the African FinTech ecosystem to enable innovators enjoy sustainable profitability to help them design and deploy affordable and inclusive financial services for the poor.

Kanzu Code can be accessed on www.kanzucode.com