The Uganda Revenue Authority-URA has warned the business community against misinterpreting the President’s directive on EFRIS (Electronic Fiscal Receipting and Invoicing Solution).

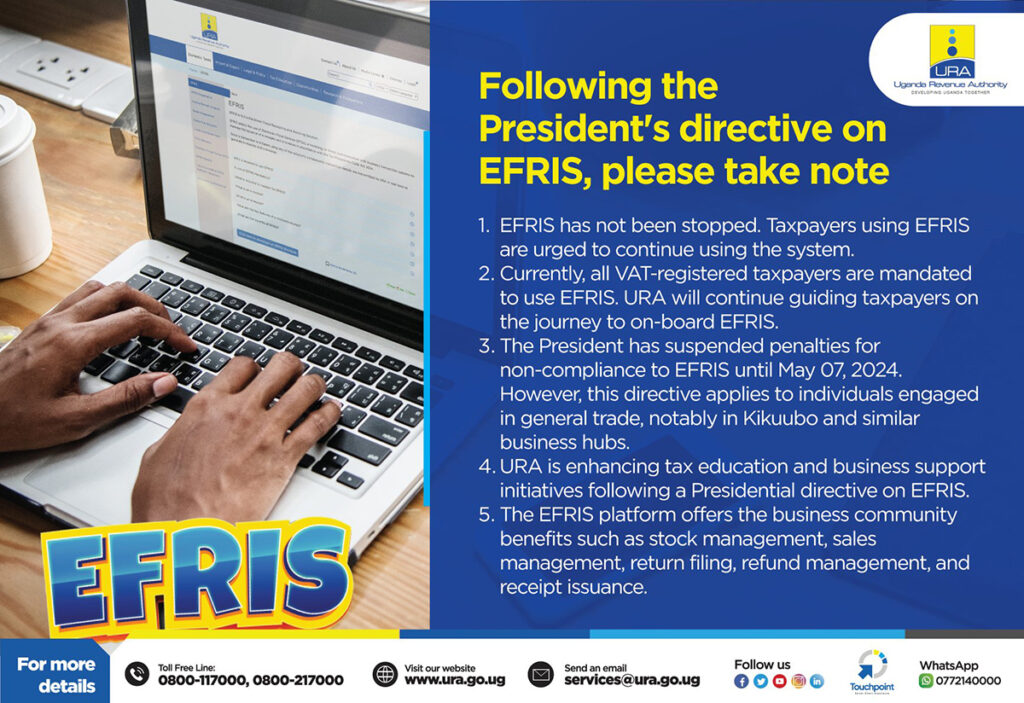

URA says the President’s directive did not stop the implementation of EFRIS and urges the taxpayers to continue using the system.

“Currently, all VAT-registered taxpayers are mandated to use EFRIS, and URA will continue guiding the business community on the journey to on-board the solution,” it says.

Clarifying the directive, URA says the President has suspended penalties for non-compliance to EFRIS until May 07, 2024.

“However, this directive applies to individuals engaged in general trade, notably in Kikuubo and similar business hubs,” the statement says.

The tax body says it is continuing with its tax education and business support initiatives following the presidential directive.

It comes as exports join in to give their views on the electronic solution, which initially, some traders had interpreted as another tax.

Julius Kenneth Okurut Member, of the Taxation and Economic Policy Panel at the Institute of Certified Public Accountants (ICPAU) says EFRIS is designed to streamline and regulate the issuance of invoices and receipts through electronic means.

This leverages digital technology to monitor transactions in real time, providing both efficiency and transparency to the tax system.

The issuance of electronic invoices and receipts, ensuring prompt recording and reflection on the URA portal is the core aim of EFRIS.

“Currently mandatory for VAT-registered taxpayers, EFRIS is expected to become crucial for tax compliance across all sectors. By fostering transparency and accountability, EFRIS aims at eliminating gaps and loopholes in tax administration, promoting fair and equitable taxation,” says Okurut.

The functionality of EFRIS revolves around three key steps including re of the taxpayers with a Tax Identification Number.

Once registered, EFRIS becomes embedded within the taxpayer’s account, allowing for the issuance of electronic invoices and receipts.

The second step is transaction processing. EFRIS ensures data protection by sending a unique one-time password to authenticate each transaction.

“Transactions can be initiated through various platforms, including Enterprise Resource Planning (ERP) systems, Point of Sale (POS) devices, and USSD codes for basic mobile phones. For most SMEs currently, the Invoicing and Receipting is done by use of the URA portal,” Okurut says.

The last stage is compliance. While EFRIS is currently mandatory for Value Added Tax (VAT) registered taxpayers, there is encouragement for others to adopt electronic receipts to avoid penalties.

There are sanctions for every e-invoice that a VAT-registered taxpayer does not raise, they will be fined 6 million shillings irrespective of the amount on the invoice.

In the quest for widespread adoption, EFRIS extends its reach to SMEs, offering guidance and support through initiatives like the Kakasa campaign encouraging compliance by URA.

Okurut says that the implementation of EFRIS brings significant benefits to both taxpayers and the Taxman, ensuring better record-keeping by providing digital transaction records, and aiding businesses in maintaining accurate financial records.

This also enhances transparency by preventing invoice trading, ensuring transaction authenticity, and fostering transparency within the business community.

Additionally, EFRIS enables efficient tax dispute resolution through access to real-time transaction data, reducing administrative burdens for both taxpayers and URA.

Moreover, e-invoices generated through EFRIS serve as legal documents, providing a secure and verifiable record of transactions.

Despite its numerous advantages, the adoption of EFRIS faces challenges such as awareness, literacy levels, and resistance from some segments of the business community mainly Kikuubo traders (Uganda’s business hub).

Okurut calls for collaboration between government agencies, business umbrella organizations like Private Sector Foundation Uganda and KACITA, professional bodies like lawyers and accountants, Bankers association, and taxpayers, which he says, will be essential in realizing the full potential of EFRIS for the benefit of Uganda’s economy and society.

“By fostering a culture of transparency, accountability, and education, EFRIS holds the promise of transforming Uganda’s tax landscape for generations to come.”