The Uganda Revenue Authority (URA) has appealed to traders who are already registered on Electronic Fiscal Receipting and Invoicing Solutions (EFRIS) to popularize it.

It emerges that those opposed to this solution think that it is a form of tax.

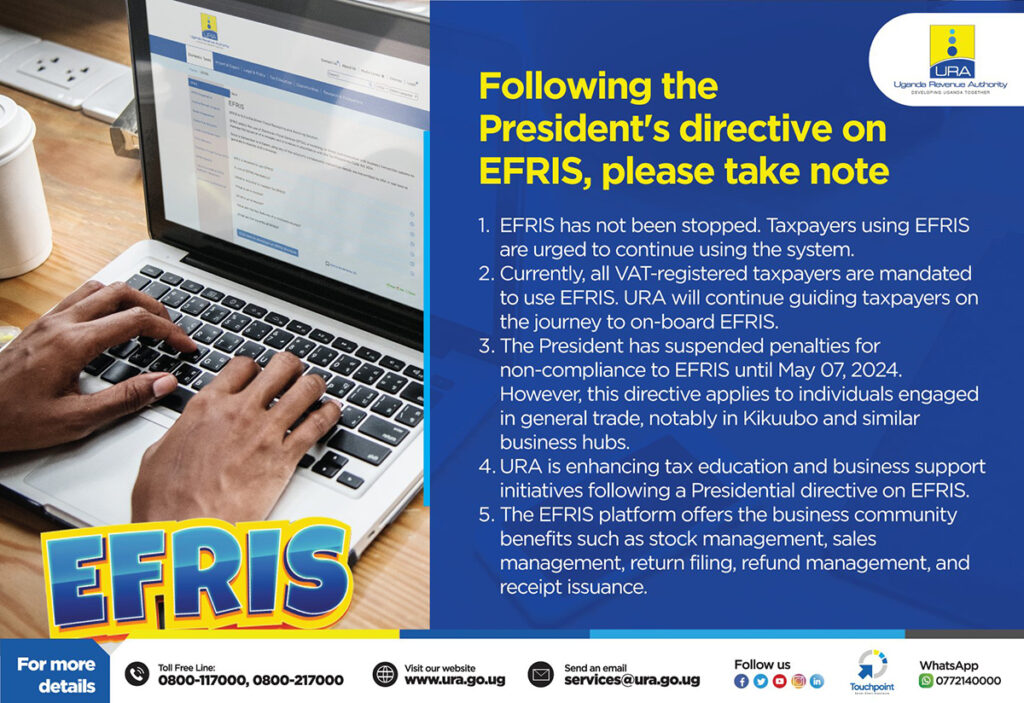

Electronic Fiscal Receipting and Invoicing Solutions (EFRIS) is a digital tax administration introduced by the Uganda Revenue Authority to monitor transactions in VATable businesses.

It is aimed at curbing VAT revenue leakage.

The system, which interfaces with a business’s transactional operations and the taxman, has been utilized by larger taxpayers since 2021.

Although over 35,000 eligible taxpayers have enrolled in the system, it has encountered resistance from smaller taxpayers, who even staged a nationwide business shutdown for four days (April 16th to 19th, 2024) until presidential intervention suspended all penalties for non-compliance with the system until May 7th, 2024.

Addressing members of the banking and financial sector at the 7th annual URA Bankers’ conference, John Musinguzi, the URA Commissioner General called upon early adopters of the tax administration technology to assist others in understanding the system’s advantages.

Musinguzi added that the tax body is aware that as tax administration transforms through technology, many challenges will arise, but the authority has established the necessary support structures to familiarize taxpayers with these developments.

“As we roll out these and many other technology initiatives, it does not come without challenges, some of which we accept as system glitches.

We have a committed team to respond, sort out, and improve any system challenges. However, the biggest challenge is the adoption of new ways of doing things,” he stated.

According to Musinguzi, if technologies like EFRIS, are fully adopted, the cost of doing business will decrease, taxation will be easier on both sides, and a level playing field will be established since assessments will be conducted fairly.

The URA Commissioner General promised more engagement regarding complaints over tax proposals but emphasized the need to keep transactions online for traceability.

The conference was organized under the theme “Financial Technology Trends and Financial Inclusion for Enhanced Tax Compliance and Transformation of Uganda’s Economy.”

Fabian Kasi, the Centenary Bank Managing Director delivered a keynote address, illustrating how financial technologies have supported financial inclusion and tax compliance in the banking sector.

Kasi pointed out that 54% of Ugandans don’t use bank services but utilize other formal services such as Mobile Money, insurance, SACCOs, and MFIs. Meanwhile, only 14% are formally banked, up from 11% in 2018 according to the Finscope Survey 2023.

He added that innovative technologies have transformed financial inclusion in Uganda in various aspects, including sending and receiving money, payments, bank deposits and withdrawals, opening bank accounts, loan origination, opening online bank accounts anywhere, internet banking, pull from/push to bank account payments, account-to-account transfers, mobile loans, etc., all of which have narrowed the inequality gap.

According to Kasi, this growth has enabled the banking sector to expand, citing Centenary Bank as an example, whose clientele has increased from 1.3 million in 2012 to 3.08 million as of last year. He also noted that this growth has expanded the bank’s deposit base, loan portfolio, and total assets.