In a new campaign dubbed “Oli Sorted for Shuwa”, Stanbic Bank says it’s giving a “credit lifeline” to its consumer and commercial clients who are hard-pressed on cash, depressed by an expensive loan repayment, or worried about school fees for the new school term.

The campaign is open to all Stanbic Bank commercial clients and their employees across the formal and informal sectors, including salary earners in the private and public sectors with a monthly income of UGX 150,000 and above.

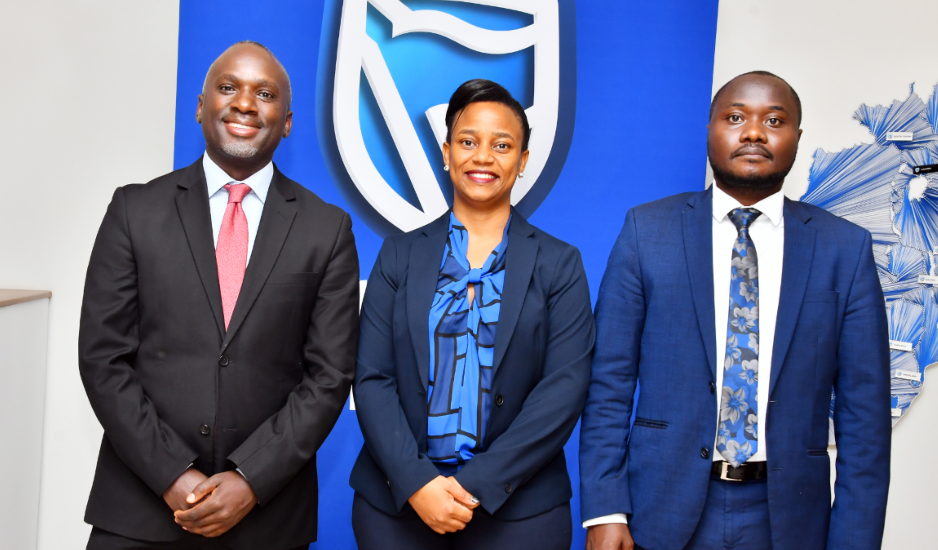

The head of personal banking, Israel Arinaitwe says “Oli Sorted for Shuwa” is designed to ease the cost of accessing and repaying loans by removing administrative fees and extending the repayment period to reduce on monthly instalments.

“This is a credit lifeline for especially our youth clients—specifically women who are also single parents, during this time as they grapple for funds to run the household and return children to school,” he said.

Knowing that many Ugandans are struggling to manage repayment of multiple loans, Arinaitwe says Stanbic Bank is offering customers the option of consolidating them into one manageable credit facility re-paid over a longer period with smaller monthly portions.

“We have introduced flexible repayment terms, allowing customers to pay their loans in smaller, affordable instalments. For example, a UGX 10 million loan can be repaid over 24 instalments instead of 12, significantly reducing the financial burden of higher monthly repayments.

Furthermore, our campaign supports young professionals aged 25-35 who have just entered employment. They can access loans of up to UGX 350 million even while on probation, provided they have a steady income from a reputable company. We encourage everyone to seize this opportunity and achieve their financial goals,” said Arinaitwe.

Business and commercial clients

Melisa Nyakwera, Head of Commercial Banking at Stanbic Bank said commercial clients especially those running schools can take advantage of the Flexi-lending which allows schools to access loans of up to UGX 500 million within a 48-hour period.

“So, the ‘Oli Sorted for Shuwa’ campaign is also designed to support our commercial clients—especially those managing schools; they can access credit to to upgrade their infrastructure, facilities, and build capacity, with loans of up to UGX 3.7 billion repayable over 10 years,” Nyakwera explained.

To improve efficiency in tuition fees collection, schools can leverage Stanbic Bank’s digital platforms, including mobile banking USSD *290#, agents, branches, and the FlexiPay app, ensuring effortless collection, enhanced security, and reduced liquidity risks.

Nyakwera emphasized that employees of institutions with existing MOUs can apply for loans at any Stanbic branch or self-service channel. Institutions without MOUs can approach any of the bank’s 87 branches to initiate the signing process.

Eligibility extends to Stanbic Bank clients, including existing customers who haven’t borrowed yet, those seeking to switch loans to Stanbic, and existing borrowers looking to top up their loans. Additionally, individuals with a good financial track record, despite not earning a salary, can also qualify for these products.

1 Comment

If stanbic bank can easen buy off process and ignore some money lenders who have gone beyond to an extend of reserving clients a/no.hence resisting them for normal loans from mother bank…