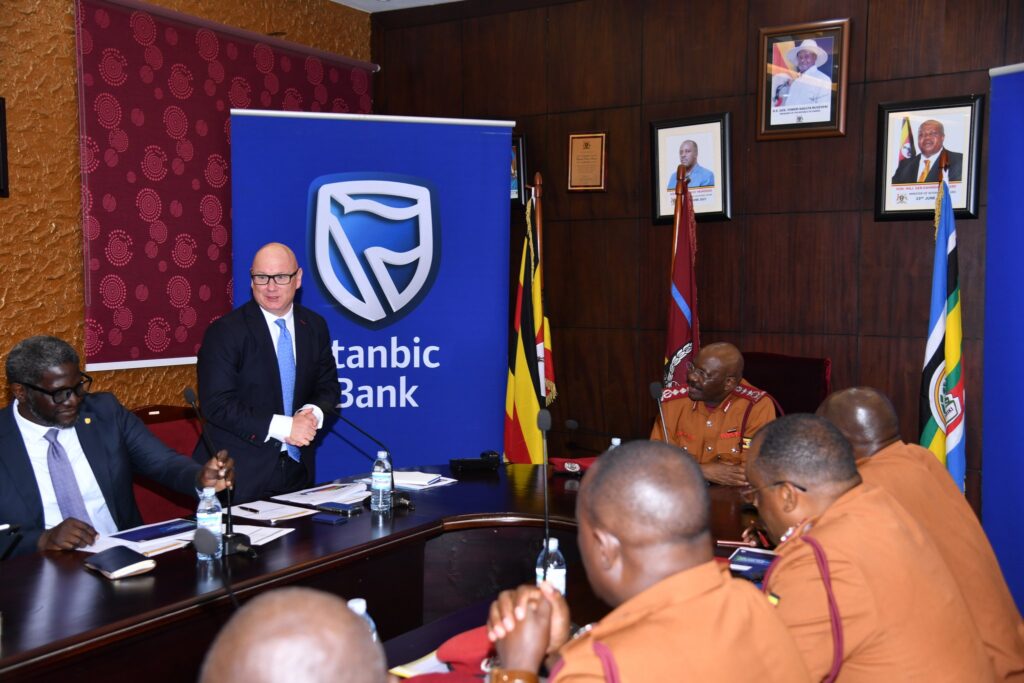

In a significant move to bolster the financial well-being of prison officers, the Commissioner General of Prisons, Can. Dr. Johnson Byabashaija, recently hosted a delegation from Stanbic Bank, a prominent member of the Standard Bank Group.

The delegation was led by Kevin Wingfield, Head of Personal and Private Banking (PPB) for the East and West African regions.

During the meeting, the two sides explored ways to enhance their partnership, focusing on innovative financial solutions and initiatives designed to improve the welfare of prison personnel at all ranks. Dr. Byabashaija expressed his appreciation for Stanbic Bank’s ongoing commitment to staff welfare through various financial literacy programs.

Emphasizing the necessity of professional development, Dr. Byabashaija directed the establishment of a financial literacy training curriculum at the Prisons Academy and Training School. This curriculum is set to be a core component of both basic training and ongoing professional growth for prison staff.

Furthermore, the Commissioner called on the bank to bolster its support for prison station-based Savings and Credit Cooperative Organizations (SACCOs) and Village Savings and Loan Associations (VSLAs) to enhance income security, transparency, and operational efficiency.

The collaboration between the Uganda Prisons Service and Stanbic Bank has already shown considerable positive impact over the past decade. To date, the bank has educated over 54,000 prison officers and their spouses across 19 regions in financial literacy, empowering them to make informed financial decisions.

Additionally, Stanbic Bank has donated essential medical equipment, including mama kits and modern delivery beds, to the Luzira Prison Clinic under its Corporate Society for Safe Motherhood (CSSM) initiative, which aims to improve maternal healthcare in Uganda.

The bank’s financial literacy programs address critical issues such as managing multiple loans, navigating financial burdens from extended family obligations, and prioritizing expenditures on limited government salaries.

Wingfield outlined the bank’s commitment to continued support for the Prisons Service, while Samuel Fredrick Mwogeza, Executive Director and Head of PPB, echoed these sentiments and presented a framework for a long-term financial partnership. This framework includes tailored product offerings specifically designed for prison officers.

In the short term, Stanbic Bank proposed the rollout of medical and life insurance under the Afya Plan, the establishment of a group-savings platform to aid micro-savings groups, and the integration of financial literacy training into the induction process for new staff.

Looking to the future, Stanbic Bank unveiled ambitious long-term plans aimed at further supporting prison staff and their families. These initiatives include a structured housing and mortgage scheme, expanded financial aid for staff families and businesses, and a scholarship program for the children of prison employees.

As the partnership progresses, both the Uganda Prisons Service and Stanbic Bank remain committed to enhancing the financial well-being of those who serve, paving the way for a more secure future for Uganda’s prison officers and their families.