For most working Ugandans, the dream of owning a decent home remains just that—a dream. With soaring construction costs, high interest rates, and a complex mortgage application process, many lower-middle-class earners find themselves locked out of the property ladder. Despite the fact that over 60% of Uganda’s urban population resides in informal settlements, the journey to homeownership is often too steep a climb.

Now, Stanbic Bank Uganda, the country’s largest commercial lender, is tearing down some of these barriers.

In a bold move that aligns with its ambition to become Uganda’s number one private bank by 2028, Stanbic has introduced a preapproved mortgage financing solution that empowers existing clients with up to UGX 500 million—without the need for the traditional loan application process.

“Homeownership should not be a privilege for a few—it should be an achievable milestone for every Ugandan who works hard and earns a stable income,” says Damalie Kairumba, Head of Mortgage Finance at Stanbic Bank. “Through this innovation, we are removing the hurdles. If you already bank with us, receive your salary or income through our systems, we can now tell you how much home financing you qualify for.”

The Innovation

This preapproved mortgage model is the first of its kind in Uganda’s banking sector. Targeting both salaried and self-employed individuals, it leverages customer banking history, income patterns, and KYC (Know Your Customer) data to automate loan prequalification—eliminating the paperwork, delays, and guesswork.

Eligible customers can use the funds to buy land or completed property, start or complete home construction, refinance or consolidate existing loans, release equity from existing property or acquire land titles for kibanja plots.

“Traditionally, the journey to owning a home was intimidating for many,” explains Israel Arinaitwe, Head of Personal Banking at Stanbic. “But by flipping the script—prequalifying our customers and putting the power in their hands—we’re making the process accessible, efficient, and dignified.”

The Numbers That Matter

According to the Uganda Bureau of Statistics (UBOS), Uganda faces a housing deficit of over 2.4 million units, a number projected to reach 3 million by 2030 if the current trajectory continues. Regionally, East Africa’s urban population is growing at an average of 4.5% annually, driving up demand for affordable and quality housing.

Yet, access to long-term mortgage financing remains painfully limited. Most banks struggle to lend long term due to limited capital markets and a low savings culture. This innovation by Stanbic is a strategic move to close the housing deficit.

With interest rates as low as 16.5% (UGX) and 9% (USD), loan amounts of up to UGX 3.7 billion (USD 1 million), and repayment periods of up to 25 years, the offering is one of the most flexible and affordable in the market.

A Partnered Approach

Stanbic is also partnering with leading real estate developers to help customers fast-track their homeownership journey.

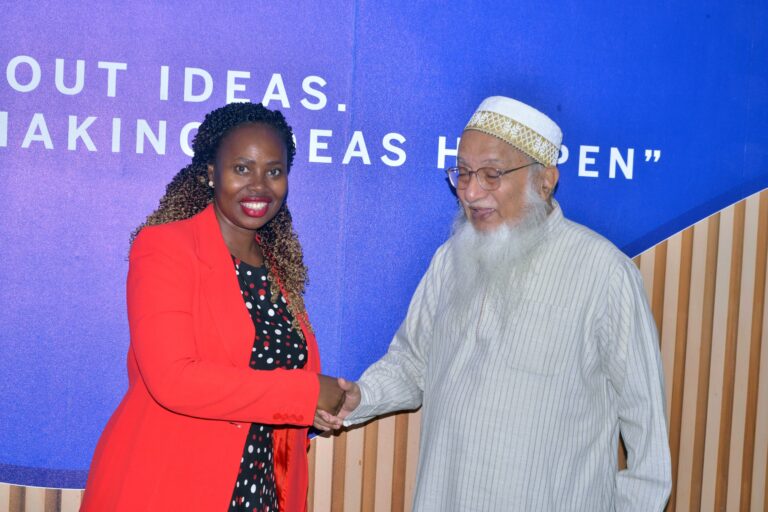

“We have worked with Stanbic to streamline the entire experience—from property identification to financing. This is how we make dreams come true,” says ‘Muffaddal Yeolawala’ Universal Multipurpose Enterprises Limited.

Another partner, Sylvia Alal Sales and Marketing Manager Peral Marina Estates Ltd adds: “This level of financial innovation is exactly what Uganda’s housing sector has needed. It means our buyers are now more confident, more empowered, and more ready to invest in long-term homes.”

How It Works

Once a prequalified customer identifies a property, valuation is done by a Stanbic-approved valuer. A written offer is issued, and upon acceptance, the mortgage is registered, and funds are disbursed. The turnaround time is driven by the customer’s readiness—but can take as little as 10 working days, including mortgage registration.

In the coming weeks, this offering will be rolled out on Stanbic’s digital platforms—allowing customers to take up the mortgage from the comfort of their home or office.

This initiative, Arinaitwe says, is a direct response to the Bank’s broader purpose of driving Uganda’s inclusive and sustainable growth.

“We believe that transforming lives starts with improving where people live,” he said, adding, “This solution is not just about financing homes—it’s about restoring dignity, building generational wealth, and shaping a more equitable future for Uganda.”