In the agriculture-dependent nations of Malawi and Zambia, smallholder farmers form the backbone of local economies. Yet, despite their critical role, these farmers face significant challenges when it comes to market access and cross-border trade especially around the Mwami-Mchinji One-Stop Border Post, a key trade point between the two countries.

Chalo Money, an emerging FinTech based in Malawi, is addressing this gap through an innovative USSD-based platform designed specifically for smallholder farmers. The platform allows farmers in remote areas to engage in digital transactions using feature phones devices far more common than smartphones in rural communities.

“We saw an opportunity to leverage the wide use of feature phones to connect farmers with better markets and fairer prices,” says Wongani Msumba, founder of Chalo Money.

“Our platform allows local and cross-border transactions, while offering affordable forex rates and transfer fees.”

Chalo Money’s goal is to simplify and formalize cross-border agricultural trade, which currently suffers from fragmented practices due to the lack of centralized market oversight. By reducing transaction costs and increasing transparency, the platform is improving economic outcomes for farmers who have traditionally operated on the margins of the digital economy.

From Idea to Execution: FinTech with Purpose

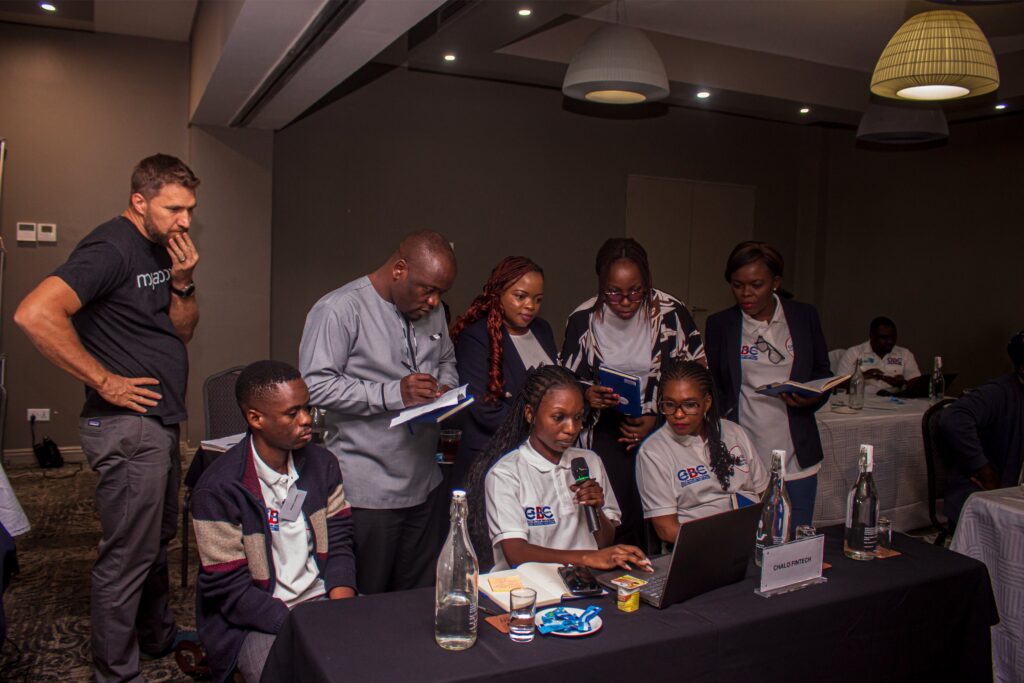

Chalo Money’s participation in the 2025 COMESA Women in FinTech Hackathon, organised by HiPipo and the COMESA Business Council (CBC), marked a major turning point in their development.

The team credits the mentorship and guidance from the hackathon with helping them refine their product’s core focus—from general transparency to specific issues like market access and control.

“The Hackathon helped us zero in on what matters most to our users,” Msumba reflects. “We realised that for farmers, access to controlled markets is just as important as secure payments.”

Horace Lwanda, Chalo Money’s technical lead, highlighted the importance of building inclusivity into the platform.

“The Level One Project’s principles like interoperability and push payments are central to our strategy. We want low-income households to participate in a broader digital ecosystem and we’re using Open APIs to bring various financial service providers together.”

Chalo Money was featured on Day 36 of the ongoing #40Days40FinTechs initiative, a Pan-African campaign that showcases innovations driving financial inclusion across the continent. The Zambia and Malawi edition builds on over five successful seasons in East Africa, during which over 200 FinTechs have been profiled.

Through platforms like Chalo Money, the #40Days40FinTechs initiative continues to spotlight the transformative power of digital financial services especially in underserved regions.